If you’ve been waiting for the market to give you a sign, this might be it. Mortgage rates just dropped to their lowest point in a year — and that’s big news for buyers and sellers alike.

The Numbers You Should Know

According to the Texas Real Estate Research Center, the average 30-year conforming rate in Texas is now 6.13%, down from 6.52% just two weeks ago. That’s the lowest we’ve seen in 12 months.

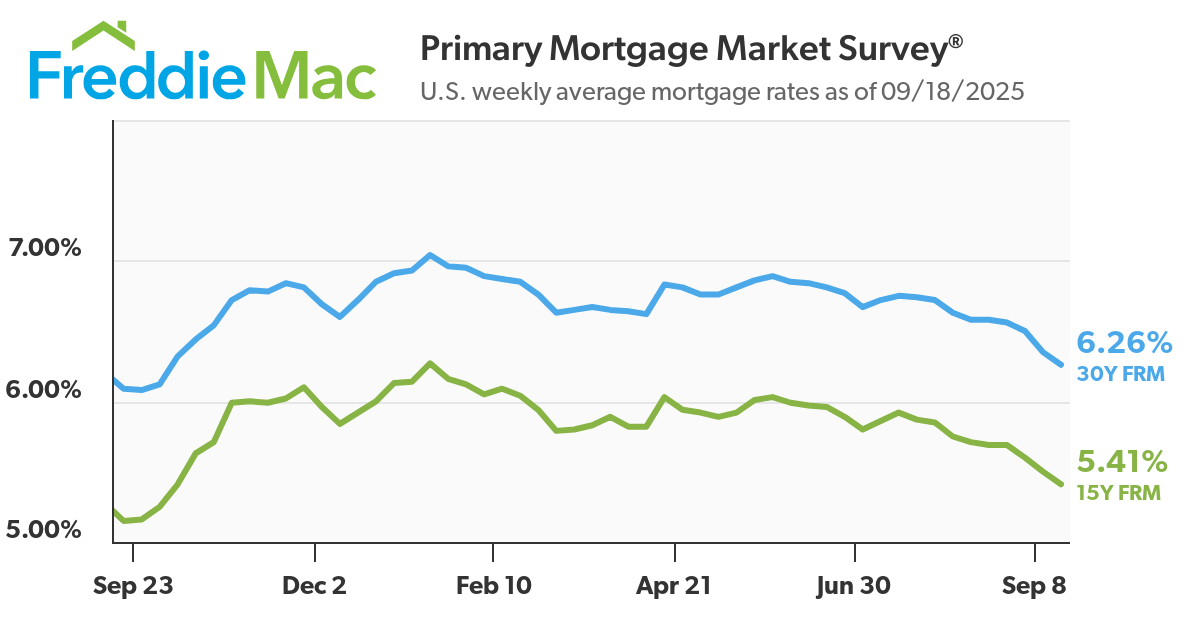

Nationally, Freddie Mac’s Primary Mortgage Market Survey (PMMS) backs this up, showing that rates have been easing across the board. It’s a shift that’s catching the attention of buyers, sellers, and investors all at once.

Why Buyers Should Pay Attention

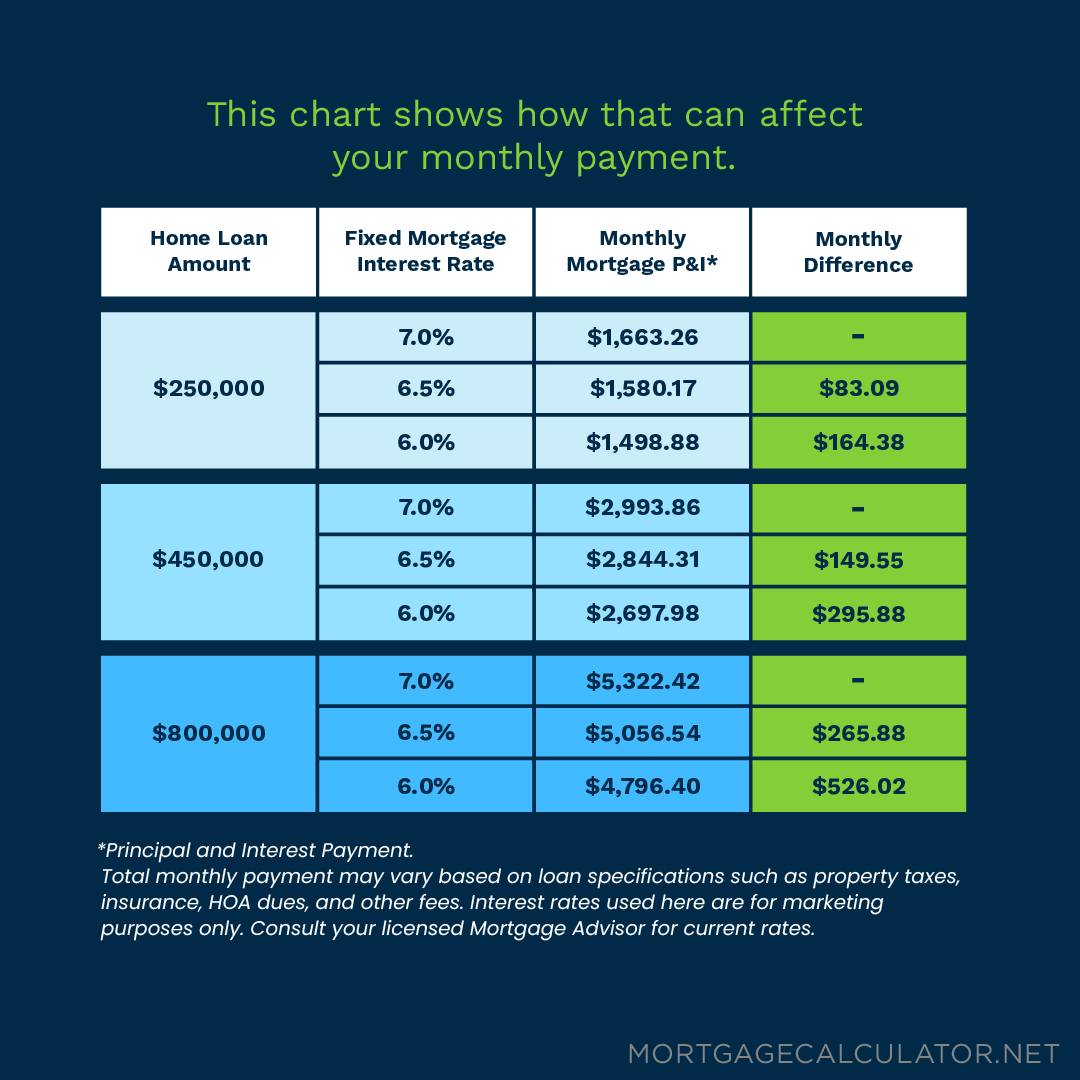

Lower rates = more buying power. For some of you, that might mean finally qualifying for a loan. For others, it could mean locking in a monthly payment that feels more comfortable. I’m already seeing more buyers jump back into the market who had been sitting on the sidelines.

Why Sellers Shouldn’t Count Themselves Out

Yes, inventory remains high, and homes are currently averaging about 90 days on the market. But this rate shift could bring in a new wave of motivated buyers. If you’ve been waiting for the “right time” to put your home back out there, this could be it. And remember — buyers love choices, but they’re also ready to negotiate. That can mean a win-win for both sides.

What’s Driving This Shift

The Federal Reserve has recently hinted at a softer approach to monetary policy due to concerns about the labor market. Investors in mortgage securities took note, and rates have been trending downward ever since. In fact, mortgage applications are already ticking up in response.

My Takeaway for You

Markets like this don’t stay still for long. If you’re thinking about buying, now’s the time to revisit your financing options. If you’re selling, you may find buyers are more serious than they were just a few weeks ago.